McEwen Mining Inc. (NYSE: MUX) (TSX: MUX)

McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is an asset rich diversified gold and silver producer in the Americas and has a large exposure to copper through its subsidiary, McEwen Copper, owner of the Los Azules copper deposit in Argentina, believed to be the 9th largest undeveloped copper resource in the world.

is an asset rich diversified gold and silver producer in the Americas and has a large exposure to copper through its subsidiary, McEwen Copper, owner of the Los Azules copper deposit in Argentina, believed to be the 9th largest undeveloped copper resource in the world.

Led by a management team with a track record of success, MUX owns and operates mines in some of the most prolific gold producing regions in the Americas. In recent months, the company has undertaken strong actions to lower production costs and increase production across its portfolio of gold assets, driving some costs below the industry average. Gold and copper prices are forecast to enter a major uptrend over the next couple years. McEwen Mining is laying the groundwork to capitalize on this opportunity now.

Seldom is management so aligned with investors’ interests with a commitment to the company’s success. CEO Rob McEwen maintains a 17% ownership stake in McEwen Mining and a 13.8% ownership in McEwen Copper with a combined cost base of roughly $220 million. McEwen founded Goldcorp, where he took the company from a market capitalization of $50 million to over $8 billion, and that same vision led MUX to create McEwen Copper.

For McEwen Mining shareholders, the company’s 51.9% stake in McEwen Copper is expected to be a gamechanger, turbocharging MUX by creating the world’s next copper unicorn.

McEwen Copper

Most mined copper is currently used in infrastructure, with new critical demand emerging for use in the electrification of transportation and the global energy transformation. The price of copper rose from a low of about $2 per pound two years ago to over $4 per pound today, and strong demand is expected to continue to soar. A study by S&P Global, titled The Future of Copper: Will the Looming Supply Gap Short-circuit the Energy Transition?, projects global copper demand to nearly double over the next decade, from 25 million metric tons today to about 50 million metric tons by 2035. Based on current trends, S&P Global projects annual supply shortfalls to reach nearly 10 million metric tons in 2035.

McEwen Mining is a 51.9% shareholder in McEwen Copper, holder of a 100% interest in the Los Azules copper project in San Juan, Argentina, which was ranked the 9th largest undeveloped copper deposit in the world by Mining Intelligence (2022). Its current copper resources are estimated at 10.2 billion pounds at a grade of 0.48% Cu (Indicated category) and an additional 19.3 billion pounds at a grade of 0.33% Cu (Inferred category). McEwen Copper also owns a copper exploration project in Nevada, called Elder Creek.

In a 2017 Preliminary Economic Assessment (PEA), Los Azules was estimated to have a 36-year life, but indications are that the project could ultimately become an even larger mine, with a longer life, since in the assessment, only 55% of the known copper resources are to be mined. Numerous drill holes have shown strong copper mineralization extending below the PEA pit bottom. Its average annual production for its first 13 years was pegged at 415 million pounds of copper in the 2017 PEA – enough copper to supply 2.2 million electric vehicles per year.

In August 2022, McEwen Copper closed its non-brokered, private placement offering of $82 million, after securing a $25 million investment from mining giant Rio Tinto’s technology arm, Nuton LLC. In February 2023, Nuton agreed to invest an additional $30 million into McEwen Copper. Its current stake in the copper subsidiary is 14.2%.

“We are extremely pleased to have Nuton’s strong continued participation in McEwen Copper,” Rob McEwen stated in a news release. “Together we are exploring new technologies that save energy, water, time and capital in the pursuit of delivering green copper to Argentina and the world, a product that will contribute to the electrification of transportation and the protection of our atmosphere.”

Also in February 2023, FCA Argentina S.A., a subsidiary of Stellantis N.V., one of the world’s leading automakers, invested ARS $30 billion in McEwen Copper to advance development of the Los Azules copper project and for general corporate purposes. Its current stake in McEwen Copper is 14.2%.

“We are delighted to have Stellantis as a partner in the future development of our Los Azules copper project,” Rob McEwen said of the investment. “Together, we share a vision to build a mine for the future based on regenerative principles that can achieve net-zero carbon emissions by 2038.”

Another of Rio Tinto’s subsidiaries, Kennecott Exploration, signed an option to earn a 60% interest in McEwen Copper’s other copper project, Elder Creek, by spending $18 million on exploration. The Elder Creek project is prospective for porphyry copper and gold mineralization and is well situated in a district hosting several large copper and gold mines, including Marigold, Lone Tree and Phoenix. Kennecott Exploration will be the operator of the exploration program. McEwen Mining holds a 1.25% net smelter return (NSR) royalty on the Elder Creek property.

Following the capital raise, McEwen Copper is well-funded to advance its Los Azules Project. Publication of an updated PEA on the Los Azules copper project is planned for Q2 2023. A Feasibility Study and IPO are planned for 2024. MUX is strategically reducing its interest to increase its treasury, in order to reduce debt and fund the further development of its gold and silver mines. In May 2023, the company decreased its senior secured debt by $25 million through the secondary sale of McEwen Copper shares.

When McEwen Copper’s Los Azules copper project is compared with other recent transactions and market valuations of copper projects in the same region, it appears very undervalued.

MUX’s management believes its ownership stake in McEwen Copper is not currently reflected in the share price of the company. In fact, it is management’s belief that the combined value of its 51.9% interest in McEwen Copper, plus its gold mines and portfolio of mineral royalties, represents a share value ranging from a low of $8 to a high of $34 per share, as detailed in the company’s latest corporate presentation.

Gold & Silver Projects

The Fox Complex

McEwen Mining owns a 100% stake in the Fox Complex in the heart of a prolific gold district in Timmins, Canada.

“When MUX bought the Fox Complex, in late 2017, it was a distressed asset with a history of high operating cost/oz. While it has taken longer than I expected, the cost to produce an ounce of gold is significantly lower,” CEO Rob McEwen stated in a news release.

In Q1 2023, McEwen Mining reported cash cost/oz at the Fox Complex of $1,088 on quarterly production of 12,700 GEOs. This was in line with the company’s guidance and marked a significant improvement from Q1 2022, when the mine struggled with effects of the pandemic and equipment failures.

Located in one of the most prolific gold production areas in the world, along the Destor-Porcupine Fault Zone within the Abitibi Greenstone Belt, the Fox Complex includes the Black Fox mine and Froome mine which together have, so far, produced in excess of 1,000,000 ounces of gold. Also, it includes the Grey Fox and Stock deposits that have an estimated additional 1,600,000 ounces in reserves and resources. The 2.7-billion-year-old Abitibi Greenstone Belt, formed by ancient volcanic activity, has proved to be one of the world’s richest and most abundant gold regions, boasting total gold content of over 300 million ounces.

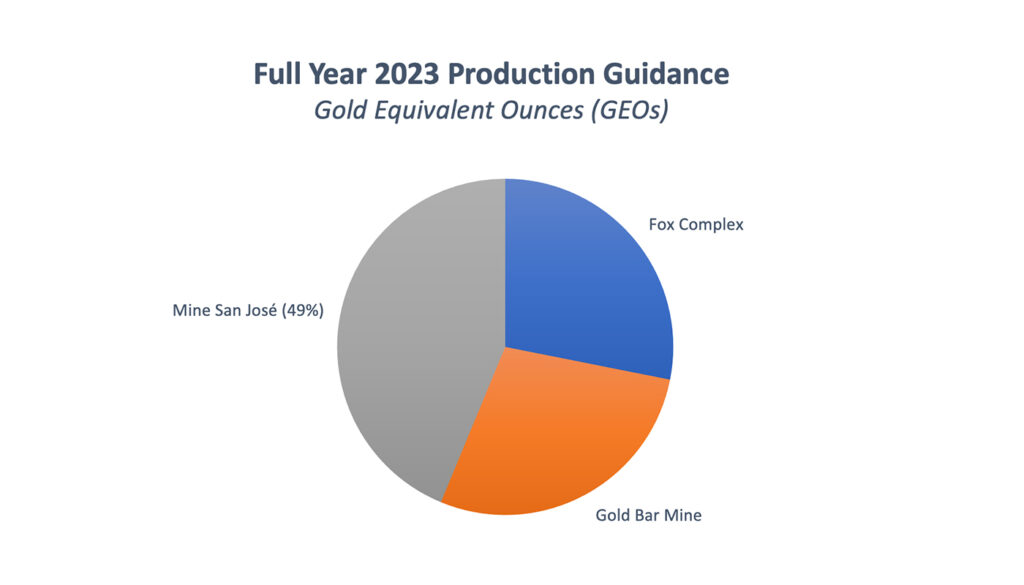

Full year 2023 guidance for The Fox Complex puts production estimates at 45,000 GEOs, 28% of MUX’s total production.

The Gold Bar Mine

McEwen Mining owns a 100% stake in the Gold Bar mine located in an area well known for gold production, the southern Roberts Mountains of the Battle Mountain-Eureka-Cortez gold trend in Eureka County, Central Nevada. The Gold Bar mine is on the same geological structure some 25 miles south of Nevada Gold Mines, a joint venture of Barrick and Newmont. This Cortez-Goldrush complex contains estimated reserves and resources of greater than 50 million gold ounces. Its annual gold production is 1,000,000 ounces.

Gold Bar had been previously mined, between 1991 and 1994, producing 134,000 gold ounces. MUX built a new facility in 2019. The open pit mine was expected to be a large contributor to MUX’s revenue and gold production, however operating challenges arose that reduced gold production and drove cost/oz unacceptably high. Mining activities have shifted recently to a nearby, satellite deposit called Gold Bar South (GBS). Going forward the expectations are higher gold production and lower operating cost/oz as a result of mining a higher ore grade (concentration of gold per ton) and having to move half the amount of material to capture an ounce of gold.

Gold Bar continued to ramp-up mining from the Gold Bar South deposit in Q1 2023, and successfully placed 15,000 contained gold ounces on the heap leach pad. Following delays due to extreme snow and rainfall, mining resumed at the site in April, which will continue to add gold inventory to the heap leach pad, contributing to the increase of production in the balance of the year.

The Gold Bar Mine will account for approximately 28% of McEwen Mining’s 2023 total attributable production, with guidance pegged at 45,000 GEOs. Most of Gold Bar production in 2023 will be from GBS.

El Gallo/Fenix

Project Fenix is the proposed redevelopment plan for McEwen Mining’s El Gallo Complex in Mexico. There is a long history of mining in this region. MUX’s involvement began in 2013 operating it as an open pit, heap leach mine which produced 281,000 gold equivalent ounces at average cash cost of $655 per ounce. However, due to the transition to deeper sulfide mineralization that is not amenable to heap leaching, mining activities ceased in the second quarter of 2018. The redevelopment envisions constructing a mill at the existing mine site that will initially reprocess the existing heap leach material then transition to open pit mining and processing the sulphide mineralization. The company recently acquired a complete process plant on very advantageous terms that has considerably reduced the projected capital requirements for the project.

CEO Rob McEwen stated in a news release, “This acquisition has made Fenix more attractive to build and could provide a new long life mine for McEwen Mining.”

The initial development approach is to build a mill to reprocess the material on the heap leach pad and produce approximately 17,000 oz of gold annually for eight years. Construction of the Fenix project is expected to be completed by early 2024.

Mine San José

McEwen Mining is a 49% owner and non-operator of the San José gold and silver mine located in Santa Cruz province, Argentina. This high-grade underground mine has been operating since 2007 and currently has an expected life of six years with a reserve grade of 342 gpt silver and 5.7 gpt gold and a resource grade of 427 gpt silver and 7.0 g/t gold.

Exploration is continuing to extend high-grade veins and discover new veins at the complex. San José’s drilling programs to define additional resources and reserves have a long history of success due to a high vein density, aided by good geophysical response from hidden veins. Drilling at the Telken target in the South of the property, and adjacent to Newmont’s Cerro Negro mine, is planned for Q3.

Production guidance for 2023 for MUX’s 49% is 70,000 GEOs, 44% of MUX’s total production. As a minority shareholder in the mine, MUX equity accounts for its investment in San Jose, and it receives 49% of the dividends from the mine’s free cash flow.

Market Outlook

Mining stocks took a beating in the wake of the COVID-19 pandemic. However, that could change, as many analysts are now forecasting a gold bull market in 2023.

“The operating challenges we faced in recent years have severely damaged our credibility with our shareholders and the market. As a result, few investors have taken a close look recently at our assets,” Rob McEwen said in a news release. “If they did, I believe some would see the potential value that I see today… I believe there is considerable potential value in MUX, and that is a big reason why I have a personal financial commitment of $220 million in MUX and McEwen Copper.”

Management Team

Robert R. McEwen is Chairman, CEO and Chief Owner of McEwen Mining. He has been associated with the gold industry all his career, with his first 18 years in the investment industry and, since 1990, as CEO of several gold mining companies. He founded Goldcorp and took that company from a $50 million market capitalization to more than $8 billion. He owns 17% of McEwen Mining and is in complete alignment with investors – the cost of his investment in MUX and McEwen Copper is $220 million and he takes an annual salary of only $1. He was awarded the Order of Canada and the Queen Elizabeth’s Diamond Jubilee Award, was inducted into the Mining Hall of Fame, was named an Ernst and Young Entrepreneur of the Year and has Honorary Doctor of Law degrees from York University and Western University.

William Shaver is interim COO and a Director of McEwen Mining. He has decades of management and executive experience in mine design, construction and operations. He was a founder of Dynatec Corporation, which became one of the leading contracting and mine operating groups in North America. In 2013, he was recognized as Ernst and Young Entrepreneur of the Year. Most recently, he served as COO of INV Metals. He is a Professional Engineer with a B.Sc. in Mining Engineering from Queens University.

Perry Ing is interim CFO at McEwen Mining. He has 25 years of experience in the Canadian mining industry. Over the past 15 years, he has held positions as CFO of Mountain Province Diamonds, Kirkland Lake Gold and McEwen Mining. Prior to that, he worked at Barrick Gold and Goldcorp and started his career in the mining practice at PwC. He has a Bachelor of Commerce from the University of Toronto and is a Chartered Professional Accountant in Canada and Certified Professional Accountant in the U.S.

Adrian Blanco S. is the company’s Director – America and Mexico Operations. He has extensive international experience in several industrial sectors and has held executive positions in Mexico, the United States, Peru and Argentina. He joined the McEwen Mining team in 2015 and has led a successful business transformation toward operational discipline, best business practices and financial profitability at subsidiaries Compañia Minera Pangea and McEwen Mining Nevada. He graduated from an Executive Management Program at IPADE and Harvard Business School.

Michael Meding is Vice President and General Manager of McEwen Copper. He has over 20 years of international experience, primarily with major mining companies such as Barrick Gold and Trafigura, including extensive experience with project development and operations in Argentina. While at Barrick Gold’s Veladero mine in Argentina, Mr. Meding played a key role in the turnaround, extension of the mine life and subsequent strategic partnering with Shandong Gold. He holds an MBA from Indiana University in Pennsylvania and an MBA from the Leipzig Graduate School of Management in Germany.

Investment Considerations

- McEwen Mining is an asset rich gold and silver producer with large exposure to copper.

- McEwen Mining CEO Rob McEwen maintains a 17.3% ownership stake in McEwen Mining with a cost base of roughly $220 million.

- McEwen Copper’s Los Azules project is one of the world’s largest and most economically robust underdeveloped copper projects.

Additional Resources

” width=”20″ height=”20″>

TraderPower Featured Companies

Top Small Cap Market News

- $SOBR InvestorNewsBreaks – SOBR Safe Inc. (NASDAQ: SOBR) Closes on $8.2M Private Placement

- $CLNN InvestorNewsBreaks – Clene Inc. (NASDAQ: CLNN) Announces Participation at Two Upcoming Investor Conferences

- $ATBHF Aston Bay Holdings Ltd. (TSX.V: BAY) (OTCQB: ATBHF) Releases Updated Report on Storm Copper Project Drilling Program

- $LGVN InvestorNewsBreaks – Longeveron Inc. (NASDAQ: LGVN) to Present at This Month’s Congenital Heart Surgeons’ Society Annual Meeting

- $LEXX InvestorNewsBreaks – Lexaria Bioscience Corp. (NASDAQ: LEXX) Begins Subject Dosing in Human Pilot Study #3 Evaluating Oral DehydraTECH-Processed Tirzepatide

- $FSTTF InvestorNewsBreaks – First Tellurium Corp. (CSE: FTEL) (OTC: FSTTF) Shares Additional Information on the PyroDelta Thermoelectric Generator, Relationship with Subsidiary

- $TMET.V Gold Stutters as Strong US Jobs Data Dampens Expectations of Large Rate Cuts

- $RFLXF JPMorgan Executive Says US Backlash Against ESG Is Exaggerated

- $SFWJ InvestorNewsBreaks – Software Effective Solutions Corp. (d/b/a MedCana) (SFWJ) Releases Report on Series of Acquisitions, Multiple Cannabis Licenses

- $EAWD IEA Hosts G20 Ministers, Influential Personalities to Discuss Clean and Affordable Energy Transition

Recent Posts

- $EAWD IEA Hosts G20 Ministers, Influential Personalities to Discuss Clean and Affordable Energy Transition

- $SFWJ InvestorNewsBreaks – Software Effective Solutions Corp. (d/b/a MedCana) (SFWJ) Releases Report on Series of Acquisitions, Multiple Cannabis Licenses

- $RFLXF JPMorgan Executive Says US Backlash Against ESG Is Exaggerated

- $TMET.V Gold Stutters as Strong US Jobs Data Dampens Expectations of Large Rate Cuts

- $FSTTF InvestorNewsBreaks – First Tellurium Corp. (CSE: FTEL) (OTC: FSTTF) Shares Additional Information on the PyroDelta Thermoelectric Generator, Relationship with Subsidiary

- $LEXX InvestorNewsBreaks – Lexaria Bioscience Corp. (NASDAQ: LEXX) Begins Subject Dosing in Human Pilot Study #3 Evaluating Oral DehydraTECH-Processed Tirzepatide

- $LGVN InvestorNewsBreaks – Longeveron Inc. (NASDAQ: LGVN) to Present at This Month’s Congenital Heart Surgeons’ Society Annual Meeting

- $ATBHF Aston Bay Holdings Ltd. (TSX.V: BAY) (OTCQB: ATBHF) Releases Updated Report on Storm Copper Project Drilling Program

Recent Comments

Archives

- October 2024

- January 2023

- June 2022

- December 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009